UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

TearLab Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

TEARLAB CORPORATION

9980 Huennekens St., Suite 100

San Diego, California 92121

NOTICE OF SPECIALANNUAL MEETING OF

STOCKHOLDERSTO BE HELD ON OCTOBER 12, 2017 AND PROXY STATEMENT

To the Stockholders of TearLab Corporation:Corp.:

Notice is hereby given that a Specialthe Annual Meeting of the Stockholders (with any amendments, postponements or adjournments thereof, the “Special(“Annual Meeting”) of TearLab Corporation, a Delaware corporation (“TearLab” or the “Company”) will be held on October 12, 2017June 21, 2018 at 8:9:00 a.m., Central Eastern Time for the following purposes:

| 1. | To | |

Elias Vamvakas

Anthony E. Altig

Joseph S. Jensen

Paul M. Karpecki

Richard L. Lindstrom

| 2. | To | |

| 3. | To vote, on an advisory basis, regarding the compensation of the named executive officers for the year ended December 31, 2017, as set forth in this proxy statement. | |

| 4. | To transact such other business as may be properly brought before |

The SpecialAnnual Meeting will be a completely virtual meeting of stockholders, which will be conducted solely via live webcast.stockholders. To participate, vote, or submit questions during the SpecialAnnual Meeting via live webcast, please visit www.virtualshareholdermeeting.com/TLB2017.TLB2018.You will not be able to attend the SpecialAnnual Meeting in person.

Details regarding howWe have also elected to attendprovide access to our proxy materials over the Special Meeting onlineInternet under the Securities and Exchange Commission’s “notice and access” rules. We believe these rules allow us to provide you with the information you need while reducing our delivery costs and the business to be conducted atenvironmental impact of the Special Meeting are more fully described in the accompanying proxy statement.

Annual Meeting. Our Board of Directors has fixed the close of business on September 6, 2017,April 27, 2018, as the record date for the determination of stockholders entitled to notice of and to vote at our SpecialAnnual Meeting and at any adjournment or postponement thereof. Our proxy materials will be sent or given on or around September 13, 2017,May 8, 2018, to all stockholders as of the record date.

Whether or not you expect to attend our SpecialAnnual Meeting via live webcast, please complete, sign and date the Proxy you received in the mail and return it promptly. You may vote over the Internet, by telephone or, if you request to receive printed proxy materials, by mailing a proxy or voting instruction card. You may also vote your shares during the SpecialAnnual Meeting. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials or proxy card you received by mail.

All stockholders are cordially invited to attend the virtual meeting.

| By Order of the Board of Directors, | |

| /s/ | |

| Elias Vamvakas | |

| Executive Chairman of the Board |

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, AND VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURNING IT IN THE ENCLOSED ENVELOPE.April 30, 2018

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The notice of special meeting and accompanying proxy statement is available to view at www.proxyvote.com

The date of this proxy statement is September 11, 2017April 30, 2018, and it is being delivered to stockholders on or about September 13, 2017.May 8, 2018.

PROXY STATEMENT

FOR 2018 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| - i - |

TEARLAB CORPORATION

9980 Huennekens St., Suite 100

San Diego, California 92121

PROXY STATEMENTFOR THE SPECIAL MEETING OF STOCKHOLDERSTO BE HELD ON OCTOBER 12, 2017

The Board of Directors of TearLab Corporation (the “Board of Directors”Corp., a Delaware corporation, or the “Board”)Company, is soliciting proxiesthe Proxy for the Specialuse at our Annual Meeting of Stockholders to be held via internet webcast on October 12, 2017. ThisJune 21, 2018 at 9:00 a.m. Eastern Time and at any adjournments or postponements thereof.

Details regarding the meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in this proxy statement contains important information forstatement. We have also made available a copy of our 2017 Annual Report to Stockholders with this proxy statement. We encourage you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.our Annual Report. It includes our audited consolidated financial statements and provides information about our business and products.

Our Board of Directors has set September 6, 2017 asWe have elected to provide access to our proxy materials over the record date forinternet under the meeting. Stockholders who ownedSecurities and Exchange Commission’s “notice and access” rules. We believe that providing our common stock atproxy materials over the close of business on September 6, 2017 are entitled to vote at and attendinternet increases the meeting, with each share entitled to one vote. On the record date, there were 5,742,453 sharesability of our common stock outstanding and no shares held bystockholders to connect with the Company in treasury stock. Oninformation they need, while reducing the record date, the closing sale priceenvironmental impact of our common stock on The Nasdaq Capital Market was $1.317 per share.

General

The enclosed proxy is solicited on behalf of the Board of Directors of TearLab Corporation, a Delaware corporation (“TearLab” or the “Company”), for use at the Special Meeting of Stockholders to be held on October 12, 2017 (the “Special Meeting”). These proxy solicitation materials are first being sent or made available on or about September 13, 2017, to all stockholders entitled to vote at the SpecialAnnual Meeting.

Voting

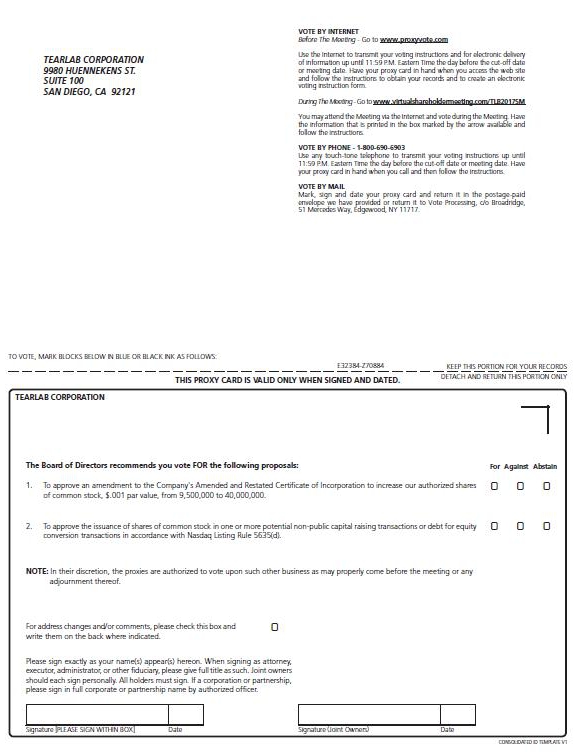

The specific proposals to be considered and acted upon at the Special Meeting are (i) to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”) to effect an increase in the number of authorized shares of the Company’s common stock from 9,500,000 to 40,000,000 with the effectiveness or abandonment of such amendment to be determined by the Board of Directors as permitted under Section 242(c) of the Delaware General Corporation Law (“Proposal One”) and (ii) to approve the issuance of securities in one or more potential non-public capital raising transactions or debt for equity conversion transactions where the maximum discount at which securities will be offered will be equivalent to a discount of 30% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d) (“Proposal Two”). On September 6, 2017, the record date for determination of stockholders entitled to notice of, and to vote at, the Special Meeting (the “Record Date”), there were 5,742,453 shares of our common stock outstanding, no shares held by the Company in treasury stock, and no shares of our preferred stock outstanding.

Each stockholder is entitled to one vote for each share of common stock held by such stockholder on the Record Date. The presence, in person or by proxy, of holders of a majority of our shares entitled to vote is necessary to constitute a quorum at the Special Meeting. The affirmative vote of a majority of the shares outstanding and entitled to vote as of the Record Date is required to approve Proposal One. As a result, abstentions, broker non-votes and the failure to submit a proxy or vote in person at the Special Meeting will have the same effect as a vote against Proposal One. Nasdaq Marketplace Rule 5635(e) requires the affirmative vote of a majority of the votes cast in person or by proxy to approve Proposal Two. Abstentions will be counted toward the vote total for Proposal Two and will have the same effect as a vote against Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and therefore will not affect the outcome of Proposal Two.

All votes will be tabulated by the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

Proxies

If the form of proxy card is properly signed and returned or if you properly follow the instructions for telephone or Internet voting, the shares represented thereby will be voted at the Special Meeting in accordance with the instructions specified thereon. If you sign and return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted as recommended by the Board of Directors. You may revoke or change your proxy at any time before the Special Meeting by filing with our Corporate Secretary at our principal executive offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, a notice of revocation or another signed proxy with a later date. You may also revoke your proxy by attending the Special Meeting and voting in person.

Costs of Proxy Solicitation

We will paybe hosting the costs and expenses of soliciting proxies from stockholders. Certain of our officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representativesAnnual Meeting live via internet webcast. You will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwardingable to attend the Annual Meeting in person. A summary of proxy materialsthe information you need to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.attend the Annual Meeting online is provided below:

Deadline for Receipt of Stockholder Proposals for● Any stockholder may listen to the Annual Meeting and participate live via internet webcast at www.virtualshareholdermeeting.com/TLB2018. The webcast will begin on June 21, 2018 Annual Meetingat 9:00 a.m. Eastern Time.

Pursuant to Rule 14a-8 of● Stockholders may vote and submit questions during the Securities Exchange Act of 1934, as amended, proposals of our stockholders that are intended to be presented by such stockholders at this SpecialAnnual Meeting and that such stockholders desire tovia live webcast.

● To enter the meeting, please have included in our proxy materials relating to such meeting must be received by us at our offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, Attn: Corporate Secretary, no later than January 5, 2018,your 12-digit control number, which is 120 calendar days prior toavailable on the anniversary of the mailing dateNotice or, if you received a printed copy of the proxy materials, relatingyour proxy card. If you do not have your 12-digit control number, you will be able to our 2017 annual meeting. Such proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, proposals of our stockholders that are intended to be presented by such stockholders at our 2018 annual meeting and that such stockholders desire to have included in our proxy materials relating to such meeting must be received by us at our offices at 9980 Huennekens St., Suite 100, San Diego, California 92121, Attn: Corporate Secretary, no later January 5, 2018, which is 120 calendar days priorlisten to the anniversary of the mailing date of the proxy materials relatingmeeting only. You will not be able to our 2017 annual meeting. Such proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

A stockholder who wishes to make a proposal at our 2018 Annual Meeting of Stockholders without including the proposal in our proxy statement and form of proxy relating to that meeting must notify us no later than March 23, 2018, unless the date of the 2018 annual meeting is more than 30 days beforevote or after the one-year anniversary of the 2017 annual meeting. If the stockholder fails to give notice by this date, then the persons named as proxies in the proxies solicited by the Board of Directors for the 2018 annual meeting may exercise discretionary voting power regarding any such proposal.

QUESTIONS AND ANSWERS

Although we encourage you to read the enclosed proxy statement in its entirety, we include this Question and Answer section to provide some background information and brief answers to severalsubmit questions you might have about the Special Meeting.

Q: Why am I receiving this proxy statement?

A: This proxy statement describes the proposals on which we would like you, as a stockholder, to vote. It also gives you information on the issues so that you can make an informed decision.

Q: How do I get electronic access to the proxy materials?

A: The notice of special meeting and proxy statement are available at www.proxyvote.com

Q: What proposals am I being asked to consider at the upcoming Special Meeting of Stockholders?

A. We are seeking approval of two proposals:

We will also transact any other business that properly comes beforeduring the meeting.

Q. Why is TearLab seeking to increase the number of authorized shares of common stock?

A. The increase in the number of authorized shares of common stock is being proposed to allow the Company to raise additional capital to fund its operations, including the expected launch of its next generation TearLab Discovery™ System as well as to improve our flexibility in responding to future business opportunities. The additional shares are also needed for the Company to continue progress● Instructions on its revised compliance plan submitted to the Nasdaq Panel (the Panel) whereby the Company is attempting to regain compliance with Nasdaq listing rules requiring a minimum stockholder equity of $2.5 million. The additional authorized shares will be available for issuance from time to time to enable us to respond to future business opportunities requiring the issuance of shares, the consummation of common stock-based financings, acquisition or strategic joint venture transactions involving the issuance of common stock, or for other general purposes that the Board may deem advisable. We are seeking approval for the amendment at this time because opportunities requiring prompt action may arise in the future, and the Board believes the delay and expense in seeking approval for additional authorized common stock at a special meeting of shareholders could deprive us of the ability to take advantage of potential opportunities.

Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital, may not comply with its debt covenants and may lose important business opportunities, which could adversely affect our financial performance and growth.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential underwritten public offering of equity securities of the Company. Unless we increase the number of authorized shares of common stock, at our current market price we would not have sufficient unissued and unreserved shares of common stock available to issue in order to raise the amount of capital listed in the registration statement.

Q. If the stockholders approve this proposal, when would the Company implement the increase in the number of authorized shares?

A. We currently expect that the increase in the number of authorized shares will be implemented as soon as practicable after the receipt of the requisite stockholder approval. However, our Board of Directors will have the discretion to abandon the increase in authorized shares if the Board does not believe it to be in the best interests of TearLab and our stockholders.

Q. Why is TearLab seeking advanced stockholder approval for the issuance of additional shares of common stock?

A. The Board is seeking advance stockholder approval as required by NASDAQ Rule 5636(d) (the “Nasdaq Rule,” as described below) to enable the Company to issue shares of Common Stock in one or more capital raising transactions or debt conversion transactions and to provide the Board with the flexibility to enter into and close such capital raising transactions on a timely basis. The Nasdaq Rule requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement with respect to such transaction. The per share price of our common stock for which we obtain future commitments, if any, in connection with a potential private placement is likely to be less than the greater of book or market value currently. As a result, the Company is seeking advance stockholder approval for the sale and issuance of such shares in connection with potential capital raising transactions or debt conversion transactions pursuant to the Nasdaq Rule. We may seek to raise additional capital to implement our business strategy and enhance our overall capitalization. In addition, we will seek to raise additional capital and/or convert a portion of our outstanding debt to equity to evidence compliance with the Nasdaq listing standards as part of our compliance plan submitted to the Panel. We have not determined the particular terms for such prospective offerings. Because we may seek additional capital that triggers the requirements of the Nasdaq Rule, we are seeking stockholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop in the equity markets.

Q. Who can vote at the Special Meeting?

A. Our Board of Directors has set September 6, 2017 as the record date for the Special Meeting. All stockholders who owned TearLab common stock at the close of business on September 6, 2017 may attend and vote at the Special Meeting. Each stockholder is entitled to one vote for each share of common stock held as of the record date on all matters to be voted on. Stockholders do not have the right to cumulate votes. On September 6, 2017, there were 5,742,453 shares of our common stock outstanding. Shares held as of the record date include shares that are held directly in your name as the stockholder of record and those shares held for you as a beneficial owner through a broker, bank or other nominee.

Q. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A: Most stockholders of TearLab hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of record — If your shares are registered directly in your name with TearLab’s transfer agent, Computershare, you are considered the stockholder of record with respect to those shares and the proxy materials have been sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to TearLab or to vote in person at the Special Meeting.

Beneficial owners — If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote and are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you request a “legal proxy” from the broker, bank or other nominee who holds your shares, giving you the right to vote the shares at the Special Meeting.

Q: Who counts the votes?

A: Voting results are tabulated and certified by Broadridge Financial Solutions, Inc.

Q. How can I vote my shares in person at the Special Meeting?

A. Shares held directly in your name as the stockholder of record may be voted in person at the Special Meeting. If you wish to vote at the Special Meeting, please review the instructions regarding how to connect and participate live via the Internet webcast, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/TLB2017. Even if you planTLB2018.

All stockholders who find it convenient to do so are cordially invited to attend the Special Meeting, TearLab recommends that you vote your shares in advance as described below so that your votemeeting via internet webcast. In any event, please complete, sign, date, and return the Proxy.

A proxy may be revoked by written notice to the Secretary of the Company at any time prior to the voting of the proxy, or by executing a subsequent proxy prior to voting or by attending the meeting and voting via live webcast. Unrevoked proxies will be countedvoted in accordance with the instructions indicated in the proxies, or if you later decide not to attendthere are no such instructions, such proxies will be voted (1) for the Special Meeting. If you hold your shares in street name, you must request a legal proxy from your broker, bankelection of our Board of Directors’ nominees as directors, (2) for the ratification of the selection of Mayer Hoffman McCann P.C. as our independent auditors for the fiscal year ending December 31, 2018, and (3) for, on an advisory basis, the compensation of our named executive officers for the year ended December 31, 2017. Shares represented by proxies that reflect abstentions or other nominee in orderinclude “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions have the same effect as votes “against” the matters, except in the election of directors. “Broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in the calculation of “votes cast.”

Stockholders of record at the close of business on April 27, 2018, or the Record Date, will be entitled to vote at the meeting or vote by proxy using the Proxy Card that was mailed to you with the Notice of Internet Availability of Proxy Materials. As of the Record Date, 10,438,998 shares of our common stock, par value $0.001 per share, were outstanding. Each share of our common stock is entitled to one vote. A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy at our Annual Meeting, constitutes a quorum. A majority of the Special Meeting.shares present in person or represented by proxy at our Annual Meeting and entitled to vote thereon is required for the election of directors, ratification of the selection of Mayer Hoffman McCann P.C. as our independent auditors for the fiscal year ending December 31, 2018, and approval, on an advisory basis, of the compensation of our named executive officers for the year ending December 31, 2017.

The cost of preparing the Notice of Annual Meeting and Proxy Statement, and mailing the Notice of Internet Availability of Proxy Materials and Proxy, will be borne by us. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians, and nominees will forward proxy soliciting materials to their principals, and that, upon request, we will reimburse such persons’ out-of-pocket expenses.

| - 1 - |

Q: How can I vote my shares without attending the Special Meeting?PROPOSAL 1

A: Whether you holdOur Amended and Restated Bylaws authorize the number of directors to be not less than five and not more than nine. Our Board of Directors currently consists of five members. Each of our directors is elected for a term of one year to serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. The five nominees for election to our Board of Directors at our upcoming Annual Meeting of the Stockholders are Elias Vamvakas, Joseph S. Jensen, Anthony E. Altig, Paul M. Karpecki and Richard L. Lindstrom, each of whom is presently a member of our Board of Directors.

A plurality of the votes of the shares directlypresent in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect directors. If no contrary indication is made, Proxies in the accompanying form are to be voted for our Board of Directors’ nominees or, in the event any of such nominees is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who shall be designated by our Board of Directors to fill such vacancy. Each person nominated for election has agreed to serve if elected and the Board of Directors has no reason to believe that any nominee will be unable to serve.

Information Regarding Directors

The information set forth below as to the nominees for director has been furnished to us by the nominees:

Nominees for Election to the Board of Directors

| Name | Age as of 4/27/18 | Position | ||

| Elias Vamvakas | 59 | Executive Chairman of the Board | ||

| Joseph Jensen | 46 | Chief Executive Officer and Director | ||

| Anthony E. Altig | 62 | Director | ||

| Paul M. Karpecki | 51 | Director | ||

| Richard L. Lindstrom | 70 | Director |

Elias Vamvakas has been the Chairman of the Board of Directors of TearLab Corporation, since June 2003, Secretary of the Company since June 2009 and was the Chief Executive Officer and Secretary of the Company from July 2004 to October 2008 and again from June 2009 to December 2015. Mr. Vamvakas co-founded TLC Vision, an eye care services company, where he was the Chairman from 1994 to June 2006 and was the Chief Executive Officer from 1994 to July 2004. Since November 2006, Mr. Vamvakas has been a member of the Board of Directors of TearLab Research, Inc. Mr. Vamvakas has been the Chairman of the Board for Greybrook Capital, a Toronto-based private equity firm. Mr. Vamvakas also serves on the board of several of Greybrook’s portfolio companies. Also, Mr. Vamvakas is the Chairman of Brandimensions Inc. and Nulogx Inc. Mr. Vamvakas was named to “Canada’s Top Forty Under Forty” in 1996. In 1999, he was named Ernst & Young’s Entrepreneur of the Year for Ontario in the Emerging Category and Canadian Entrepreneur of the Year for Innovative Partnering. In 2000, Mr. Vamvakas was recognized by Profit Magazine for managing one of Canada’s fastest growing companies. Mr. Vamvakas received a BSc degree from the University of Toronto in 1981. Mr. Vamvakas’ extensive business background and familiarity with TearLab qualifies him to serve on the Board.

Joseph Jensen has served as the stockholderChief Executive Officer and a member of record or beneficiallythe Board of TearLab Corporation since January 2016. Mr. Jensen previously served as the Chief Operating Officer of TearLab Corporation from October 2013 to December 2015. Mr. Jensen has over twenty years of experience in street name, you may direct how your shares are voted without attendingpharmaceutical and medical device sectors spanning sales, sales management, marketing, and international positions. He is a proven leader with consistent performance and commensurate promotions at a Fortune 50 company. From 1996 to 2013, Mr. Jensen served in managerial roles, most recently as the Special Meeting. If you arehead of surgical marketing of Alcon Laboratories, Inc. (“Alcon”), a stockholderdivision of record, you may vote by submittingNovartis. From 1995 to 1996, Mr. Jensen served as territory manager of Warner Lambert. From 1994 to 1995, Mr. Jensen served as district manager of Payroll Services. Mr. Jensen graduated from Flagler College with a proxy; please referBA in Business and Communications and a minor in Advertising. Mr. Jensen brings to the voting instructionsBoard an in-depth knowledge and understanding of our business as an executive officer of the Company.

Anthony E. Altig has been a member of TearLab Corporation’s Board since January 2009. Mr. Altig was the Chief Financial Officer at Biotix Holdings, Inc., a company that manufactures microbiological and molecularbiological consumables up until his retirement in December 2017, after Biotex was acquired by Mettler-Toledo. From December 2004 to June 2007, Mr. Altig served as the Chief Financial Officer of Diversa Corporation (subsequently Verenium Corporation), a public company focused on enzyme technology. Prior to joining Diversa, Mr. Altig served as the Chief Financial Officer of Maxim Pharmaceuticals, Inc., a public biopharmaceutical company, from 2002 to 2004. From 2000 to 2001, Mr. Altig served as the Chief Financial Officer of NBC Internet, Inc., an internet portal company, which was acquired by General Electric. Mr. Altig’s additional experience includes his role as the Chief Accounting Officer at USWeb Corporation, as well as his experience serving biotechnology and other technology companies during his tenure at both PricewaterhouseCoopers and KPMG. In addition, Mr. Altig serves as a director for Assembly Biosciences. Mr. Altig is a former member of the Board of Directors of Optimer Pharmaceuticals and MultiCell Technologies, Inc. Mr. Altig received a BA degree from the University of Hawaii. Mr. Altig’s experience as Chief Financial Officer of several public companies brings to the Board perspective regarding financial and accounting issues.

| - 2 - |

Paul M. Karpecki, O.D., FAAO has been a member of TearLab Corporation’s Board since March 2010. Also, he has been a Director of Cornea and External Disease at Kentucky Eye Institute since September 2016 and prior to that the Director of Ocular Disease Research at Kentucky Eye Institute since September 2009. In 2007, Dr. Karpecki joined the Cincinnati Eye Institute in Corneal Services after spending five years as the Director of Research for the Moyes Eye Clinic in Kansas City. Dr. Karpecki serves as the Chair of the Refractive Surgery Advisory Committee to the American Ophthalmology Association (“AOA”) and on the AOA Meetings Executive Committee. He has lectured in more than three hundred symposia covering four continents and was the first optometrist to be invited to both the Delphi International Society at Wilmer-Johns Hopkins and the National Eye Institute’s dry eye committee. A noted educator and author, Dr. Karpecki is the Chief Clinical Editor for the Review of Optometry Journal. He is a past President of the Optometric Council on Refractive Technology and serves on the board for the charitable organization, Optometry Giving Sight. Dr. Karpecki received his Doctorate of Optometry from Indiana University and completed a Fellowship in Cornea and Refractive Surgery at Hunkeler Eye Centers in affiliation with the Pennsylvania College of Optometry in 1994. Dr. Karpecki’s experience in optometry and specialization in dry eye disease make him a valuable addition to the Board.

Richard L. Lindstrom, M.D. has been a member of TearLab Corporation’s Board since September 2004. Since 1979, Dr. Lindstrom has been engaged in the enclosed proxy card or below. If you hold shares beneficiallyprivate practice of ophthalmology and is a founder, a director, and an attending surgeon of Minnesota Eye Consultants P.A., a provider of eye care services. Dr. Lindstrom has served as Associate Director of the Minnesota Lions Eye Bank since 1987. He is also a medical advisor for several medical device and pharmaceutical manufacturers as well as a member of the board of directors of several private and public companies in street name, you may vote by submitting voting instructionsthe ophthalmology sector. Dr. Lindstrom is a past President of the International Society of Refractive Surgery, the International Intraocular Implant Society, the International Refractive Surgery Club, and the American Society of Cataract and Refractive Surgery. From 1980 to your broker, bank or other nominee; please refer1989, he served as a Professor of Ophthalmology at the University of Minnesota, and he is currently an Adjunct Professor Emeritus in the Department of Ophthalmology at the University of Minnesota. Dr. Lindstrom received his Doctor of Medicine, Bachelor of Arts, and Bachelor of Sciences degrees from the University of Minnesota. Dr. Lindstrom’s background in ophthalmology gives him a perspective that is helpful to the voting instructions providedBoard for understanding the Company’s product market.

| - 3 - |

The Board held nine meetings during 2017. No director who served as a director during the past year attended fewer than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of committees of the Board on which he or she served.

The Board currently has, and appoints members to, youtwo standing committees: our Compensation Committee, and our Audit Committee. The current members of our committees are identified below:

| Director | Compensation | Audit | ||||

| Anthony E. Altig (1) | [X] | [X] | ||||

| Paul M. Karpecki | [X] | [X] | ||||

| Richard L. Lindstrom (2) | [X] | [X] |

(1) Audit Committee Chair.

(2) Compensation Committee Chair.

| - 4 - |

Compensation Committee. The Compensation Committee currently consists of Dr. Karpecki, Mr. Altig, and Dr. Lindstrom, with Dr. Lindstrom serving as chairman. The Compensation Committee held one meeting during 2017. All members of the Compensation Committee are independent as determined under the various NASDAQ Stock Market, U.S. Securities and Exchange Commission, or SEC, and Internal Revenue Service qualification requirements. The Compensation Committee is governed by your broker, bank ora written charter approved by the Board. The charter is available on our website at www.tearlab.com. The functions of this committee include, among other nominee.things:

| ● | ||

| ● | ||

| ● |

Q. What happens if I do not cast a vote?

A.Stockholders of record — If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Special Meeting. However, if you submit a signed proxy card with no further instructions, the shares represented by that proxy card will be voted as recommended by our Board of Directors.

Beneficial owners — If you are a beneficial owner and you do not provide your broker, bank or other nominee that holds your shares with voting instructions, then your broker, bank or other nominee will determine if it has discretion to vote on each matter. Brokers do not have discretion to vote on non-routine matters. Proposal One and Proposal Two are each non-routine matters. As a result, if you do not provide voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee may not vote your shares with respect to Proposal One or Proposal Two, which would result in a “broker non-vote” on each proposal..

Q. How can I change or revoke my vote?

A. Subject to any rules your broker, bank or other nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Special Meeting.

Stockholders of record — If you are a stockholder of record, you may change your vote by (1) filing with our Corporate Secretary, prior to your shares being voted at the Special Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy relating to the same shares, or (2) attending the Special Meeting and voting in person (although attendance at the Special Meeting will not, by itself, revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Special Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or should be sent so as to be delivered to our principal executive offices, Attention: Corporate Secretary.

Beneficial owners — If you are a beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, bank or other nominee, or (2) attending the Special Meeting and voting in person if you have obtained a legal proxy giving you the right to vote the shares from the broker, bank or other nominee who holds your shares.

In addition, a stockholder of record or a beneficial owner who has voted via the Internet or by telephone may also change his, her or its vote by making a timely and valid later Internet or telephone vote no later than 11:59 p.m., Eastern Time, on October 11, 2017.

Q: What is a proxy card?

A: The proxy card enables you to appoint Joseph Jensen and Wes Brazell, with full power of substitution, who we refer to as the proxyholders, as your representatives at the Special Meeting. By completing and returning the proxy card, you are authorizing the proxyholders to vote your shares at the meeting, as you have instructed them on the proxy card. Even if you plan to attend the meeting, it is a good idea to complete, sign and return your proxy card or vote by proxy via the Internet or telephone in advance of the meeting just in case your plans change. You can vote in person at the meeting even if you have already sent in your proxy card.

If a proposal comes up for vote at the meeting that is not on the proxy card, the proxyholders will vote your shares, under your proxy, according to their best judgment.

Q. What if I return my proxy card but do not provide voting instructions?

A. Proxies that are signed and returned but do not contain instructions will be voted “FOR” Proposal One and “FOR” Proposal Two.

Q. If I hold shares through a broker, how do I vote them?

A. Your broker should have forwarded instructions to you regarding the manner in which you can direct your broker as to how you would like your shares to be voted. If you have not received these instructions or have questions about them, you should contact your broker directly.

Q. What does it mean if I receive more than one proxy card?

A. It means that you have multiple accounts with brokers and/or our transfer agent, Computershare. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address.

Q. How may I obtain a separate set of proxy materials?

A: If you share an address with another stockholder, each stockholder may not receive a separate copy of the proxy materials. Stockholders who do not receive a separate copy of the proxy materials may request to receive a separate copy of the proxy materials by contacting our Investor Relations department (i) by mail at 9980 Huennekens St., Suite 100, San Diego, California 92121, (ii) by calling us at (858) 455-6006, or (iii) by sending an email to lroth@theruthgroup.com. Alternatively, stockholders who share an address and receive multiple copies of our proxy materials may request to receive a single copy by following the instructions above.

Q: What is a “broker non-vote”?

A: A broker non-vote occurs when a broker holding shares in street name does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. In order to effect the increase of authorized shares of common stock contemplated by Proposal One, Delaware law requires the approval of the holders of a majority of TearLab’s outstanding shares of common stock, and not merely the approval of a majority of the shares represented in person and by proxy at the Special Meeting. Therefore, a broker non-vote will count as a vote against Proposal One. Nasdaq Marketplace Rule 5635(e) requires the affirmative vote of a majority of the votes cast in person or by proxy to approve the issuance of securities in one or more non-public offerings contemplated by Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and, therefore, will not affect the outcome of Proposal Two.

Q. How many votes must be present to hold the meeting?

A. Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct the meeting, a majority of our outstanding shares of common stock as of September 6, 2017 must be present in person or by proxy at the meeting. This is referred to as a quorum.

Q. How are different votes treated for purposes of establishing a quorum and determining whether the proposal has passed?

A. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the meeting with respect to the proposal. Abstentions will have the same effect as a vote against both Proposal One and Proposal Two. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum. Broker non-votes will have the same effect as a vote against Proposal One and will have no effect on the outcome of Proposal Two.

Q. Why is my vote important?

A. Your vote is important because Proposal One must receive the affirmative vote of a majority of shares outstanding in order to pass and Proposal Two must receive the affirmative vote of a majority of the votes cast in order to pass. Also, unless a majority of the shares outstanding as of the record date are voted or present at the meeting, we will not have a quorum, and we will be unable to transact any business at the Special Meeting. In that event, we would need to adjourn the meeting until such time as a quorum can be obtained.

Q: Who is soliciting my vote?

A: We will pay the costs and expenses of soliciting proxies from stockholders. Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of the election. Certain of our officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representatives will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwarding of proxy materials to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.

PROPOSAL ONE

APPROVAL OF A PROPOSED AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK

OVERVIEW

Our Certificate of Incorporation (the “Certificate”) currently authorizes us to issue a total of 9,500,000 shares of common stock, $0.001 par value, and 10,000,000 shares of preferred stock, $0.01 par value. Our Board of Directors has approved, and is seeking stockholder approval of, an amendment to our Certificate of Incorporation (the “Amendment”) to implement an increase in the number of shares of authorized common stock, $0.001 par value, from 9,500,000 shares to 40,000,000.

The Board is proposing the Amendment, in substantially the form attached hereto as Appendix A, to increase the number of authorized shares of our common stock from 9,500,000 shares to 40,000,000 shares. Of the 9,500,000 shares of common stock currently authorized by the Certificate, as of September 6, 2017, 5,742,453 shares are issued and outstanding, 1,324,000 shares are reserved for issuance upon exercise of existing stock purchase warrants, 567,941 shares are reserved for future issuance under existing equity incentive awards and 28,601 are reserved for purchases under the Company’s Employee Stock Purchase Plan. Therefore, we currently have limited authorized shares of common stock available for future issuance.

The Board has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and recommends that our stockholders approve the Amendment. In accordance with the General Corporation Law of the State of Delaware, we are hereby seeking approval of the Amendment by our stockholders.

No changes to the Certificate are being proposed with respect to the number of authorized shares of preferred stock. Other than the proposed increase in the number of authorized shares of common stock, the Amendment is not intended to modify the rights of existing stockholders in any material respect. The additional shares of common stock to be authorized pursuant to the proposed amendment will be of the same class of common stock as is currently authorized under our Certificate of Incorporation.

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the proposed amendment to our Certificate of Incorporation to increase the number of authorized shares of common stock, and we will not independently provide stockholders with any such rights.

REASONS FOR THE AMENDMENT

The Company recently conducted an extensive and thorough strategic review of the alternatives available to it that included a broad marketing effort to solicit interest in a sale or other transaction to maximize value for all shareholders. During the process, TearLab received expressions of interest relating to a variety of potential transactions including interest to both acquire and invest in the Company. After careful consideration, the Company’s board of directors determined that the interests of the Company’s stockholders are best served by focusing on execution of the Company’s strategic business plan. The Company may from time-to-time receive indications of interest and have discussions regarding possible strategic alternatives, and intends to consider proposals it receives in the future that it believes could result in the creation of stockholder value. However, the Company is now focused on executing its strategic business plan which will require additional capital to fund its operations, provide the appropriate resources to launch its next generation platform and comply with its debt covenants.

The Board of Directors believes that the proposed increase in the number of authorized shares of common stock will benefit the Company by providing the shares needed to raise additional capital to execute its business plan as well as improving our flexibility in responding to future business opportunities. The additional authorized shares will be available for issuance from time to time to enable us to respond to future business opportunities requiring the issuance of shares, the consummation of common stock-based financings, acquisition or strategic joint venture transactions involving the issuance of common stock, or for other general purposes that the Board may deem advisable. We are seeking approval for the amendment at this time because opportunities requiring prompt action may arise in the future, and the Board believes the delay and expense in seeking approval for additional authorized common stock at a special meeting of shareholders could deprive us of the ability to take advantage of potential opportunities.

Without an increase in the number of authorized shares of common stock, the Company may be constrained in its ability to raise capital, may not be able to fund its operations, may not comply with its debt covenants and may lose important business opportunities, which could adversely affect our financial performance and growth. In addition, the Company would not be able to execute the compliance plan submitted to the Nasdaq Panel to regain compliance with minimum Nasdaq listing requirements.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential underwritten public offering of equity securities of the Company. Unless our stockholders approve this proposal and the Amendment to increase the number of authorized shares of common stock, at our current market price we would not have sufficient unissued and unreserved shares of common stock available to issue in order to raise the amount of capital listed in the registration statement.

In determining the size of the proposed authorized share increase, the Board considered a number of factors, including the amount of capital needed to fund its operations and launch its next generation platform, the potential terms needed to raise additional capital including the potential issuance of warrants to purchase common stock associated with equity financings and that over a number of years the Company may potentially need additional shares in connection with future equity transactions, acquisitions or other strategic transactions. If the stockholders do not approve the Proposal, then the Company will not have the needed additional shares available to raise the capital to execute its business plan and it may default on its debt covenants in the future.

While this Proposal One is intended to facilitate the Company regaining compliance with Nasdaq listing standards, even if the Company is successful in increasing the number of authorized shares available and can pursue the capital raising transaction(s) contemplated in Proposal Two, or via the Form S-1 registration statement, there can be no assurance that the Company will regain compliance with the Nasdaq minimum listing standards or that the Company’s common stock will continue to be listed on The Nasdaq Capital Market.

The Board of Directors does not intend to issue any common stock except on terms which the Board deems to be in the best interests of the Company and its then existing stockholders.

POTENTIAL EFFECTS OF THE AMENDMENT

The proposed increase in the number of authorized shares of common stock will not have any immediate effect on the rights of our existing stockholders. The Board will have the authority to issue the additional shares of common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of any stock exchange on which our securities may be listed. The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock, and, depending on the price at which additional shares may be issued, could also be dilutive to the earnings per share of our common stock.

It is possible that a subsequent issuance of these shares could have the effect of delaying or preventing a change in control of the Company. Shares of authorized and unissued common stock could, within the limits imposed by applicable law, be issued in one or more transactions that would make a change in control of the Company more difficult, and therefore, less likely. Issuances of additional shares of our stock could dilute the earnings per share and book value per share of our outstanding common stock and dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. While it may be deemed to have potential anti-takeover effects, the proposal to increase the authorized common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company.

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.

EFFECTIVENESS OF AMENDMENT

If the Amendment is approved by our stockholders, it will become effective upon the filing of an amendment to our Certificate of Incorporation, which filing is expected to occur promptly after stockholder approval of this proposal. The text of Appendix A remains subject to modification to include such changes as may be required by the Secretary of State of the State of Delaware and as the Board deems necessary or advisable to implement the increase in our authorized shares.

APPROVAL REQUIRED

The affirmative vote of the holders of a majority of the shares of the Company’s common stock outstanding as of the record date is required to approve the proposed amendment to the Company’s Amended and Restated Certificate to increase our authorized shares of common stock, $.001 par value, from 9,500,000 to 40,000,000. Abstentions and “broker non-votes” will not be counted as having been voted on the proposal and, therefore, will have the same effect as negative votes.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends that the stockholders vote “FOR” the proposed amendment to the Company’s Amended and Restated Certificate to increase our authorized shares of common stock, $.001 par value, from 9,500,000 to 40,000,000.

PROPOSAL TWO

APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK IN ONE

OR MORE POTENTIAL NON-PUBLIC CAPITAL RAISING TRANSACTIONS OR DEBT TO EQUITY

CONVERSION TRANSACTIONS IN ACCORDANCEWITH NASDAQ LISTING RULE 5635(d)

OVERVIEW AND REASON FOR THE PROPOSAL

The Board is seeking advance stockholder approval as required by NASDAQ Rule 5635(d) (the “Nasdaq Rule,” as described below) to enable the Company to issue shares of common stock in one or more non-public capital raising transactions or debt to equity conversion transactions and to provide the Board with the flexibility to enter into and close such non-public capital raising transactions or debt to equity conversion transactions on a timely basis.

The Nasdaq Rule requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance at a price less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement with respect to such transaction. The per share price of our common stock for which we obtain future commitments, if any, in connection with a potential private placement is likely to be less than the greater of book or market value.

As a result, the Company is seeking advance stockholder approval for the sale and issuance of such shares in connection with potential non-public capital raising transactions or debt to equity conversion transactions pursuant to the Nasdaq Rule. We may seek to raise additional capital to implement our business strategy and enhance our overall capitalization. In addition, we will seek to raise additional capital and/or convert a portion of our outstanding debt to equity to evidence compliance with the Nasdaq listing standards as part of our compliance plan submitted to the Panel. Moreover, the Company’s audited financial statements for the fiscal year ended December 31, 2016 were prepared on the basis that the Company will continue as a going concern and, given the Company’s financial position, the Company will need additional financing to continue in operation.

We have not determined the particular terms for such prospective offerings. Because we may seek additional capital that triggers the requirements of the Nasdaq Rule, we are seeking stockholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop in the equity markets.

Specifically, we are seeking stockholder approval, for the purpose of compliance with the Nasdaq Rule, for the potential issuance of shares subject to the following limitations approved by our Board:

| ||

| ● |

Role and Authority of Compensation Committee

The Compensation Committee is responsible for discharging the responsibilities of the Board with respect to the compensation of our executive officers. The Compensation Committee approves all compensation of our executive officers without further Board action. The Compensation Committee reviews and approves each of the elements of our executive compensation program and continually assesses the effectiveness and competitiveness of our program. The Compensation Committee also periodically reviews director compensation.

The Role of our Executives in Setting Compensation

The Compensation Committee meets with our Chief Executive Officer, Mr. Jensen, and/or other executives at least once per year to obtain recommendations with respect to Company compensation programs, practices, and packages for executives, directors, and other employees. Management makes recommendations to the Compensation Committee on the base salary, bonus targets, and equity compensation for the executive team and other employees. The Compensation Committee considers, but is not bound by and does not always accept management’s recommendations with respect to executive compensation. The Compensation Committee has the ultimate authority to make decisions with respect to the compensation of our named executive officers, but may, if it chooses, delegate any of its responsibilities to subcommittees.

Mr. Jensen attends some of the Compensation Committee’s meetings, but the Compensation Committee also regularly holds executive sessions not attended by any members of management or non-independent directors. The Compensation Committee discusses Mr. Jensen’s compensation package with him, but makes decisions with respect to his compensation outside of his presence.

| - 5 - |

Audit Committee. The Company has engagedAudit Committee consists of Dr. Karpecki, Dr. Lindstrom, and Mr. Altig, with Mr. Altig serving as chairman. The Audit Committee held four meetings during 2017. All members of the Audit Committee are independent directors (as independence is currently defined in Rules 5605(a)(2) and 5605(c)(2) of the NASDAQ Listing Rules). Mr. Altig qualifies as an investment bank to assist“audit committee financial expert” as that term is defined in the Company in identifying potential investorsrules and opportunities, but has not arrived at any specific terms.regulations established by the SEC. The final terms of any such transaction will be determinedAudit Committee is governed by a written charter approved by the Board. If this Proposal Number TwoThe charter is approved, the Company will not solicit further authorization from its stockholders prior to any such capital raising transaction.

In addition, on August 21, 2017, the Company filed a registration statement on Form S-1 related to a potential publicly marketed offering of equity securities of the Company. While the issuances contemplated by this Proposal Two are separate from the issuances contemplated by the registration statement, the issuances contemplated by this Proposal Two could be used by the Board in addition to the issuance of additional common stock via the S-1 registration statement in order to regain compliance with Nasdaq listing standards.

While this Proposal Two is intended to facilitate the Company regaining compliance with Nasdaq listing standards, even if the Company consummates the capital raising transaction(s) contemplated by this Proposal Two, or via the Form S-1 registration statement, there can be no assurance that the Company will regain compliance with the Nasdaq minimum listing standards or that the Company’s common stock will continue to be listed on The Nasdaq Capital Market.

POTENTIAL EFFECTS OF THE PROPOSAL

The issuance of additional shares of common stock will decrease the relative percentage of equity ownership of our existing stockholders, thereby diluting the voting power of their common stock, and, depending on the price at which additional shares may be issued, could also be dilutive to the earnings per share of our common stock. It is possible that a subsequent issuance of these shares could have the effect of delaying or preventing a change in control of the Company. Shares of authorized and unissued common stock could, within the limits imposed by applicable law, be issued in one or more transactions that would make a change in control of the Company more difficult, and therefore, less likely. Issuances of additional shares of our stock could dilute the earnings per share and book value per share of our outstanding common stock and dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. While it may be deemed to have potential anti-takeover effects, the proposal to authorize the Board to issue additional shares of common stock is not prompted by any specific effort of which we are aware to accumulate shares of our common stock or obtain control of the Company.

The additional authorized shares of common stock, if and when issued, would be part of the existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Stockholders do not have preemptive rights with respect to our common stock. Therefore, should the Board determine to issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase such shares in order to maintain their proportionate ownership thereof.

The Board of Directors has not yet determined the terms and conditions of any offerings. As a result, the level of potential dilution cannot be determined at this time, but as discussed above, we may not issue more than 20,000,000 shares of common stock in the aggregate pursuant to the authority requested from stockholders under this Proposal Two. It is possible that if we conduct a non-public capital raising transaction or debt to equity conversion transaction, some of the shares we sell could be purchased by one or more investors who could acquire a large block of our common stock. This may concentrate voting power in the hands of a few stockholders who may then be able to exercise greater influenceavailable on our operations or the outcome of matters put to a vote of stockholders in the future.

We cannot determine what the actual net proceeds of any transactions contemplated by this Proposal Two would bewebsite at this time, but as discussed above, the aggregate dollar amount of the non-public offerings will be no more than $20 million. If such a proposed transaction is completed, the net proceeds will be used for general corporate purposes. We currently have no arrangements or understandings regarding any specific transaction to be effected pursuant to the approvalwww.tearlab.com. The functions of this Proposal Two, so we cannot predict whether we will be successful should we seek to raise capital through any such offerings.

EFFECTIVENESS OF PROPOSALcommittee include, among other things:

If the proposal is approved by our stockholders, it will become effective immediately and will remain in force for three months or until such time that the board may issue the maximum amount of authorized shares approved in this proposal.

APPROVAL REQUIRED

The affirmative vote of a majority of the votes cast in person or by proxy is required to approve the proposal to authorize the board to issue up to 20,000,000 shares of stock at a maximum discount of 30% below the market price of our common stock at the time of issuance with total aggregate consideration no to exceed $20 million and up to three months subsequent to the approval by stockholders. Abstentions will be counted toward the vote total for Proposal Two and will have the same effect as a vote against Proposal Two. Because Proposal Two is a non-routine matter, broker non-votes will not be counted as votes cast on Proposal Two and therefore will not affect the outcome of Proposal Two.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommends a vote “FOR” the approval of the issuance of shares of common stock in one or more potential capital raising or debt to equity conversion transactions in accordance with Nasdaq rule 5636(d).

ADDITIONAL INFORMATION

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the Company’s common stock as of September 6, 2017 (unless otherwise indicated), by:

| ● | ||

| ● | ||

| ● | ||

| ● |

Both our independent auditors and internal financial personnel regularly meet privately with our Audit Committee and have unrestricted access to this committee. The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Director Qualifications

In evaluating director nominees, the independent members of the Company’s board of directors consider, among others, the following factors:

| ● | experience, skills, and other qualifications in view of the | ||

| ● | diversity of background; and | ||

| ● | demonstration of high ethical standards, integrity, and sound business judgment. |

The Company’s board of director’s goal is to assemble a Board that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience which are well suited to further the Company’s objectives. In doing so, the independent members of the board of directors also consider candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the independent members of the board of directors may also consider such other facts as it may deem are in the best interests of the Company and its stockholders. The board of directors does, however, believe it appropriate for at least one, and, preferably, several, members of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board meet the definition of an “independent director” under the NASDAQ Stock Market qualification standards.

Identification and Evaluation of Nominees for Directors

In January 2018, in connection with the resignations of members of the Company’s board of directors, the Company’s board of directors eliminated the Corporate Governance and Nominating Committee of the Board and assumed the responsibilities previously delegated to the Corporate Governance and Nominating Committee. As such, the Board no longer has a standing nominating committee and there is no formal nominating committee charter, although the Board has adopted a resolution addressing the director nominations process. Instead, the directors who are determined to be “independent” under the various relevant qualification requirements perform the functions of a nominating committee. The Board believes it is appropriate not to maintain a standing nominating committee primarily because the relatively small number of independent directors on the Board makes it unnecessary to separate the nominating function into a committee structure.

The independent members of the Company’s board of directors identify nominees for Board membership by first evaluating the current members of the Board willing to continue in service. Current members with qualifications and skills that are consistent with the Company’s criteria for Board service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the independent members of the Company’s board of directors identifies the desired skills and experience of a new nominee in light of the criteria above including consultation with management. The independent members of the Company’s board of directors may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The independent members of the Company’s board of directors review the qualifications, experience, and background of the candidates. Final candidates are interviewed by our independent directors and Chief Executive Officer. In making its determinations, independent members of the Company’s board of directors evaluate each individual in the context of the Board as a whole, with the objective of assembling a group that can best attain success for the Company and represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the independent members of the Company’s board of directors determine which candidates to nominate for election by the stockholders. Historically, the Company’s board of directors has not relied on third-party search firms to identify Board candidates. The independent members of the Company’s board of directors may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify and acquire an appropriate candidate.

| - 6 - |

The Company’s board of directors has not received director candidate recommendations from our stockholders and does not have a formal policy regarding consideration of such recommendations since it believes that the process currently in place for the identification and evaluation of prospective members of the Board is adequate. Any recommendations received from stockholders will be evaluated in the same manner as potential nominees suggested by members of the Board or management. Stockholders wishing to suggest a candidate for director should write to the Company’s Chief Financial Officer.

Communications with the Board of Directors

Our stockholders may send written correspondence to non-management members of the Board to the Chief Financial Officer or Chief Executive Officer at 9980 Huennekens St., Suite 100, San Diego, California 92121. Our Chief Financial Officer or Chief Executive Officer will review the communication, and if the communication is determined to be relevant to our operations, policies, or procedures (and not vulgar, threatening, or of an inappropriate nature not relating to our business), the communication will be forwarded to the Chairman of the Board. If the communication requires a response, our Chief Financial Officer will assist the Chairman of the Board (or other directors) in preparing the response.

Code of Conduct and Code of Ethics

We have established a Code of Conduct and Code of Ethics that applies to our officers, directors and employees. The Code of Conduct and Code of Ethics contain general guidelines for conducting our business consistent with the highest standards of business ethics, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K. The Code of Conduct and Code of Ethics is available on our website at www.tearlab.com. If we make any substantive amendments to the Code of Conduct and Code of Ethics or grant any waiver from a provision of the Code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Corporate Governance Documents

Our corporate governance documents, including the Audit Committee Charter, Compensation Committee Charter, Code of Conduct and Code of Ethics are available free of charge on our website at www.tearlab.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide copies of these documents free of charge to any stockholder upon written request to Investor Relations, TearLab Corporation, 9980 Huennekens St., Suite 100, San Diego, California 92121.

The following is the report of the Audit Committee with respect to the Company’s audited consolidated financial statements for the year ended December 31, 2017.

The purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of the Audit Committee. All of the members of the Audit Committee are independent directors under the NASDAQ and SEC audit committee structure and membership requirements.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and Mayer Hoffman McCann, P.C., the Company’s independent auditors for the year ended December 31, 2017. Management is responsible for the preparation, presentation and integrity of our consolidated financial statements, accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13A-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. Mayer Hoffman McCann, P.C. is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America.